Best 7 Ways to Teach Your Kids About Money

Having noticed the impact of financial management to success, it is surprising that schools do not teach enough financial education the right way. This overlooked skill is so essential that it could be the obvious difference between your children living on paychecks and living a comfortable life. It is very important that you let your kids to embrace financial literacy and teach them on how to manage money. Here are seven tips that will help you to educate your kids about money:

Use Clear Jars

Unlike piggy banks, clear jars give a clear representation of your kids’ saving progress. It is crucial for the kids to see the money growing so that it keeps them encouraged to continue saving. As a parent, it is your responsibility to make a big deal out of it. Fun activity: Prepare 3 clear jars and label them as follows, “Saving, Spending and Sharing” The breakdown of how much your child should put inside each jar is up to them. However, financial experts recommend 50% for spending, 40% for savings and 10% for sharing. Cool tip: Another cool thing you can do to motivate your child is to paste the item your child is saving for on the spending jar.Be a Good Example

As a role model to your child, it is important for you to lead by example. Practice what you preach and do what you say. If you are telling your kids to save money but you spend excessively on irrelevant things, you are creating confusion. Note that these young ones are watching your steps and they are likely to develop your traits and habits.Take the initiative

Actions speaks loud. It is simple to say that an action figure costs 200 bucks. Make these kids to experience the transaction by giving them room to save for their toys. When their money jar gets filled, allow the kids to decide how they want to spend their money: whether to continue saving or to spend it on the toy. If the chose the option to purchase a toy, turn their coins into bills and make them pay for the toy themselves. This simple act will give them a vivid and clear understanding of how financial transactions work.Education between needs and wants

Do not always yield to your kids’ whims as that could give them the impression that they have the green light to purchase whatever they want. Better yet, try to reveal and show them the difference between needs and wants. Start gradually and be creative in your approach! You can create interactive game sessions to prove this point to them.Take them along with you to the Bank

You can take your child along with you to your bank and create a savings account when their saving jar gets filled. Make them to know the importance of keeping their money safe and how their money grows when it is kept in the bank. This is a good starting point which will help the child to know the value of saving money and investing it.Turn them into motivated workers

After teaching your kids on the importance of managing money, emphasize this point by showing them the difficulty of earning money. This can be done using a chore-reward scheme where you give them some money whenever they follow instructions and do chores properly. If they fail to do these chores properly, then, do not give them the full amount or do not give them any money at all. Make them to know what it takes to earn money.Record their saving and spending

One of the best ways to teach children about money is by teaching them to record their saving and spendings. Give them a notebook and a pen to note down their daily, weekly and monthly savings goals. Furthermore, you can reward them whenever they achieve a certain milestone: it could be some cash, a new toy or some clothes. Teaching children about money is not a day’s job but a life-long process. No matter how hard you try to train them for the future, experience remains the best teacher. As kids, they may make mistakes - which is quite understandable. Conclusively, ensure that you make them to develop these habits early in life so that they can avoid many financial loopholes as possible.Five Social Media tips for small business online success

About 65% of customers follow and like the pages of businesses, organizations, brands and companies on various social media networks? What does this mean for your business?

Staying active on social media platforms can help to give your business a strong online presence. Also, it helps to boosts your businesses popularity and can also help you to build a loyal audience from scratch.

Five Tips to Make the Best of Social Media As an Entrepreneur

There are several ways and methods you can use social media to promote and improve the overall appearance of your business. In order to help you to do channel your efforts, we have identified five techniques you can use to increase the social and online presence of your business.

1. Begin With a Plan

First of all, you need to have a plan because most of your efforts in building a social media presence for your business will be channelled into creating content for the platforms you plan on using.

For example, you can plan on using video posts for Facebook, Infographics and hashtags on Twitter and photos on Instagram.

Your plan should cover methods on how you intend to create the content and the interval in posting the content.

If you want to attract an engaging audience on social media networks, you have to be strategic and tactical in your approach and this is why you need to plan carefully.

While creating a plan, carefully think about your mission statement and the goals you intend to achieve. For example, is your goal to boost your business visibility and identity online? Get traffic to your website? Offer support to customers? Boost customer engagement and conversion?

As you formulate your plan, you will want to figure out your audience, the best tools and platforms to get them, your budget and how often you would keep them engaged with new contents.

You can consider asking yourself the following set of questions:

- How do I get content ideas?

- What is the interval for posting content?

- What social media networks do I use?

- Which social media platforms can I get my audience and customers?

- What can I offer to potential customers to keep them away from patronizing my competitors?

After thinking about the questions above, you can consider going through the following facts as you form your plan:

- Facebook is the most popular and commonly social media platform in the world.

- After Facebook, the next popular social media networks that improve business social presence is LinkedIn, Twitter, Instagram and Pinterest.

- Every social media platform has a specific attraction for its users. For instance, LinkedIn is a lively platform for businesses, corporations and professionals while Instagram consumes visual content such as photos and videos.

Social media experts recommend businesses to concentrate on two or three social media platforms to post content regularly. If you are regular in posting content, your audience and customer base will increase.

If you select more than three, you may not be consistent in posting contents on all platforms. It is advised that you hire a social media manager to assist in posting content regularly to keep your customers and audience engaged.

2. Be Proactive

If you want to build a successful social media presence online, your objective should be to post fresh and new content which should interest your audience.

Interesting and informative posts are contents that people tend to like, comment and share after they must have gone through them.

If you are finding it difficult to come up with content ideas, pay attention to your competitors and find out what they are doing?

Find out how your competitors keep their audience engaged with their content and check if the content is getting shared by people or getting comments from the audience.

Also, on your own, you can make research and figure out the strategy that would work well for you.

Bear it in mind that you can like, retweet or share previous posts to spark your audience and keep them engaged. You don’t necessarily need to post new content to resonate with your audience..

3. Use Compelling Photos and Videos When Possible

Also, people can get bored to read long lines of text, you can keep your audience engaged on social media by uploading images and videos when necessary.

Here are some of the discoveries made by Hubspot:

- Tweets with images received more than 150% retweets than tweets without images.

- Pictures with faces on Instagram get 30% more Likes than images without faces.

- On Facebook, posts with pictures get 2.3X more engagement than posts without pictures.

It is a good idea to think about the videos and pictures that would fit into your content. For instance, if you are into a retail business, you can consider uploading images of your products/goods, coupled with the location and some beautiful pictures of your staff flocked around the product.

If you offer services and digital products, you can make tutorial and how-to videos to make your audience know about the service, how to use them and the benefits of the service.

4. Always Be Active

A recent study showed that over 32% of social media users who have tried to reach out to a brand on social media expect to get a swift response within 30 minutes. Also, over 42% of social media users expect a response in a time frame of 60 minutes.

Although, it is almost impossible for you to give fast responses to all social media users who contact you, however, quick response to comments, queries and questions go a long way in showing these customers how you care about them.

Thank customers for leaving positive reviews in comments, answer questions and address negative posts and clarify them to put things right.

5. Present Your Values

Social media is a great platform for you to tell your business values, mission and vision to the world. Also, with social media, you can build a group or community to exhibit your values and reveal your personality.

If you want to resonate and connect well with your audience, you have to be unique in coming up with original content for your audience to consume.

Some platforms may provide with tools to offer promotions to your customers, however, it is important for you to build a bridge with your customers and make them trust you before recommending your products to them.

If you are pushing them to get your products, you may not generate money or make sales because you don’t have a relationship with them. Therefore, make it a priority to rapport with your audience.

If you are yet to understand how social media marketing for business works, all you need to do is to stick with a few networks, make a plan, share and create informative and interacting content, respond to messages and comments from customers. In doing this, you will be using the platform to build your business.

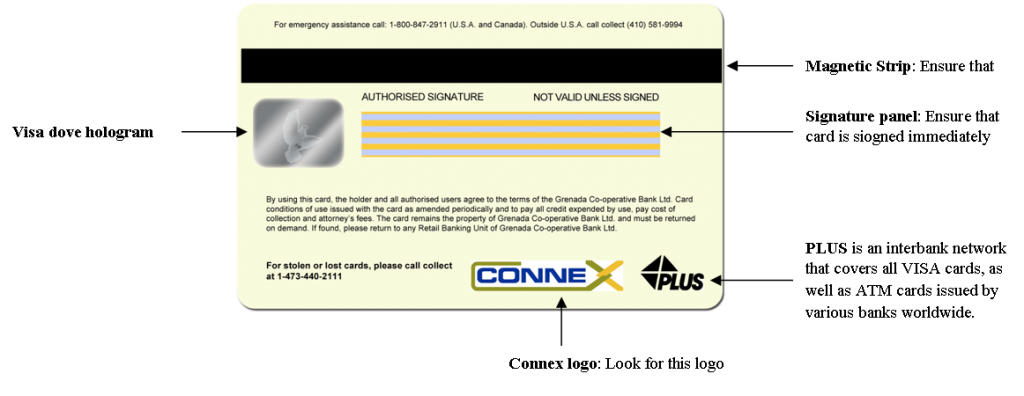

At the time of collecting your Co-op Bank Visa® International Debit Card from your Retail Banking Unit (RBU) representative, you will be invited to select your own PIN and sign the card on the signature panel provided at the back of the card, in the presence of the RBU representative.

Merchants are not required to accept your card as a method of payment if it is presented unsigned, unless you can produce sufficient picture identification to satisfy the merchant that you are the legitimate cardholder.

As customary, your PIN will allow you access to your funds via any ATM of Co-op Bank, the Connex® service or Visa® Plus ® network. It remains very important that you keep your PIN secure and confidential.

There is no requirement for you to disclose your PIN to anyone at anytime.

As a safety precaution, you should routinely keep your PIN separate from your Co-op Bank Visa® International Debit Card and make every attempt to memorize the PIN so as to reduce the need to record it on paper.

In the event that you forget your PIN, please feel free to visit any Co-op Bank RBU to select a new PIN.

Report Lost or Stolen Cards

It is your responsibility to safeguard your Co-op Bank Visa® International Debit Card. However, in the event that it is lost or stolen, you should notify the nearest Co-op Bank RBU immediately, by telephone (473-440-2111) or in writing, so that we can block new transactions from being authorized against your designated account.

Emergency contact information for usage when at home or abroad is provided on the reverse side of your Co-op Bank Visa® International Debit Card.

Remember that transactions performed before you notify us of any issues or unauthorized usage will remain your responsibility.

About your Visa® International Debit Card

Investing in property is one of the best investments because it is tangible and has increasing value that is favored by Inflation

Many Grenadians hesitate to invest in property because it is costly. Add to that fact that Inflation creates more pressure to invest sooner as property prices soar. But what if we told you that it is one of the best investments you can make right now, whether it’s short or long term?

Investing in property is one of the best investments because it is tangible and has increasing value that is favored by Inflation. If you’re on the fence about investing in property, then this article is for you.

Here are the reasons why property is the best investment you can make right now:

Real estate value increases over time, usually

Unlike cars which depreciate over time, real estate value increases, almost always, annually. Part of the reason is the increasing population in urban areas—which spikes the demand for apartments and private houses near Central Business Districts. According to Lamudi, real estate value is guaranteed to increase in the next two years as demand remains high. This makes investing in property not only a lucrative investment, but also a safe one.

You have control over your investment

Investing in property gives you a tangible asset that you can do a lot with. You can rent it out, use it as a storage area, or live in while you wait for the market price to go higher. You basically have control over your destiny and if the market dampens, you can always keep it, or sell it at a later date.

Property has high tangible asset value

Unlike stocks which value can get to zero, or a car which decreases its value over time, a property has a high tangible asset value. This means that it has a physical form and it has a natural value. Tangible assets are beneficial against economic uncertainty since there will be always a natural value in your property. Just don’t forget to have an insurance in order to protect your property from unforeseen disasters.

Property works well with Inflation

Property and Inflation has a positive relationship towards each other. As economies expand, the demand for property drives rents higher, and so does the value of your property. Compared to the stock market which has a lot of factors that can negatively impact your investment, property and rent values tend to go up during times of high inflation.

In Conclusion

Although costly, investing in property is one of the best—if not the best investment you can make right now. Since properties have a high tangible asset value, you have control within your investment. You can rent it out, sell it, or keep it. Due to high demand, your property is guaranteed to increase in value for the next few years—making it a safe investment.

It's never too early to start planning your retirement

The process of preparing for retirement presents a bit of a paradox. The longer interest is allowed to accumulate on a sum of money the larger the sum will grow (particularly if additional amounts are added) Consequently, saving for retirement is most effective when started early in life, but this is the time when people are generally the least interested in doing so. Saving for retirement is least effective when started later in life, but this is the time when people have the greatest amount of motivation to do so. Once a person is convinced that it is to his advantage to begin investing for the future then the next step is to revise their personal budget to include a retirement fund category. Let’s take a look at how a person might go about incorporating this in with their monthly expenses.

Steps Toward Establishing a Retirement Budget:

Determine when you wish to retire.

This will help an individual know how long he has to save, and in turn, roughly how much he will need to put aside each month.

Calculate retirement expenses.

It is impossible to project completely accurate totals; however, a close ballpark figure should be attainable. This is done through a careful examining of all current expenses to determine if they will still be applicable, as well as, adding on any additional costs. For example, many retirees experience an increase in “entertainment expenses”. Since they have an increased amount of free time, they spend more money on hobbies, travel, etc.

Adjust for inflation.

It is important to realise that 10, 20, or 30 years from now the cost will be higher in accordance with inflation. Failing to adjust for this factor could lead to a severe shortage of funds.

Do the math.

Once you know how much you need and when you need it you can calculate how much you will need to save between now and then.

Don’t be overly optimistic.

When calculating how much you will need to save each month, resist the urge to assume that you will average a 18% (or any other number on the high side) annual return. This may happen occasional, but chances are very strong that you will not average this return over the course of the investment. Choose a more conservative percentage because it truly is better to be safe than sorry. If it turns out you make 18% then great, you’ll have extra money in your account.

Four Steps for buying a used vehicle

Start with research

Take some time to think about how you plan to use this car. For example, if you have a family, you’ll want enough room for everyone plus ample cargo space. Narrow the field by making a list of must-have features. Then, search for models with those features using tools such as Car Finder on Edmunds.com. As you move forward, build a list of three target car models to research in more detail.Research the recent resale prices for those specific car models. This data will give you major bargaining power. If you plan to trade in your current car, research market values for your vehicle, too. Knowing the value of your trade-in can also be a powerful bargaining tool.Plan your budget

Figuring out how much you are willing to spend on a used car is the next thing you need to do, and for good reason. First of all, buying a used car opens the door to other expenses such as licensing fees, insurance, and taxes. As a rule of thumb, you should not spend more than 20 percent of your salary on a used car, especially if you have other financial responsibilities and bills to pay. Additionally Keep in mind that a used car is probably going to require maintenance and a change of tires, unlike a brand new vehicle, so be prepared to set some money aside for any hidden costs you may encounter down the road.Test drive the vehicle adequately.

Take the chosen vehicle for a comprehensive test drive. This should last about 30 minutes and should be done on various road conditions. Make sure to test all the accessories on the car. You'll want to factor that non-functioning air conditioning into the price but you have to know about it first.Have the car inspected

Are you a certified master mechanic? If not, make sure you get the vehicle inspected before you buy it. Many people buy cars and then take them to a mechanic to be checked out. That's the wrong order. Finding something after the purchase will not prevent you from buying the car. The horse has left the barn, as they say.One of the keys for saving for any life event is to plan and start saving as early as possible. When planning for a family there are so many things to consider. One of the major costs is saving for your child’s education. Here are five tips to help get you off the ground.

1. Start Early:

Each year, tuition fees increase and the earlier you get a start on saving for higher education, the more time you have to make your money grow. Imagine contributing $1000 every year to your child’s university/college education from the time of birth. By the age of 18 you would have an initial saving of $18,000 without factoring in the additional savings that interest rate contributes.

2. Research cheaper alternatives:

Distance education and online degrees are more than just a fad. For many students it is more cost effective to study online. Also, planning to study part-time while still working can help alleviate some of the anxiety around having adequate financing for school because you will still be generating an income while studying.

3. Think about financing through scholarships and bursaries.

Many financial institutions offer additional financing through scholarships and bursaries. In many cases, scholarships help to cover the cost of tuition, books and other living expenses for the first few years or even the duration of studies. Seeking additional financing is a good way to help cost the cost of some of the annual expenses that come along with being in university or college

4. Think Ahead:

make a financial plan for the institution that you may want your child to attend. If studying abroad is the goal, research the country or city where you would like your child to attend. This way you can plan for cost such as of campus housing and other living expenses.

6. Making Investments:

Consider investing savings so that your money can grow while you save

Working while studying is never an easy feat. Life’s demands drag you in multiple directions and it becomes quite a balancing act to juggle full or part-time work and your studies. For many students, funding their studies through full or part-time work is the only means of financing their education. Here is how to maintain a positive work/life balance so that your studies or your job does not suffer.

Consider taking on full-time or part-time work that is related to your studies. If you are working in a job that is related to some of the skills that you are learning in the classroom, it becomes a great way to gain practical, professional experience in your field. Also, when you can readily apply what you learn in the classroom to your job, juggling both responsibilities become less daunting.

Before applying for any part-time job, you should first think about your study schedule. Be honest with yourself about the hours and type of work that you can take on. Time management is a key component to academic and professional success. So, you should ensure that your time is managed effectively by making schedules, prioritizing your work and honestly assessing the amount of time you waste.

Your physical and emotional well-being plays a major role in your academic, professional, and personal success. Take time to establish and maintain an active plan for staying healthy. Remember, nothing will get done well if you are emotionally or physically drained. Plan exercise and creative activities into your week to help keep you energized.

Managing the multiple demands of your job and school, can be challenging, but you can be successful. Many students work and study simultaneously, so you are surely not alone

Here is a quick guide of five Do’s and Don’ts to consider when thinking about leaving the comforts of home for your study abroad adventure.

Five Do’s

- Plan Ahead: Wanting to continue your education after secondary school should never come as an unexpected surprise. Do, take the time to plan ahead by researching the college and university options available in the region and abroad. Make a list of your top choices regarding programs, tuition fees and work-study options before making a final decision on a college or university.

- Hunt for Scholarships and Bursaries: As an international student, you are often paying some very high fees in tuition. Fortunately, many institutions offer a variety of financing options through scholarships and bursaries. It is also worthwhile to hunt for scholarships and bursaries through community organizations, student clubs, volunteer opportunities and/or through work-study programs. It helps to become familiar with the international student office at your school. There are numerous financial resources available to you while studying.

- Strive for Balance: It takes time and practice to create a balance among your life, work and studies. When you go abroad to study at a university or college, it is easier to divert from your studies, especially when you are doing a part-time job. It is important to organize your life to make the most of your time abroad. Consider creating a schedule to factor in the responsibilities that require your time. Remember, your priority should always be your studies- set the biggest portion of your time towards it.

- Work After Graduation: If you would consider living temporarily in your country of study, take the time to find out more information about postgraduate opportunities for employment. Many universities and colleges help their new grads to find employment opportunities in their various fields of interest. Explore the opportunities provided at the career centre in your institution to help prepare for life after graduation

- Document Your Experiences: Write about your best encounters and the things that you learned from those memorable and challenging experiences. The new experiences that you will have and the people that you will meet will create some of the most unforgettable moments in your time abroad.

Five Don’ts

- Don’t forget hidden costs: Studying abroad can become extremely expensive if you have not planned for expenses outside of the cost of school fees. Remember to research the cost of living for the city/country where you decide to study. Expenses such as immigration, rent- if you live off campus, telephone bills, groceries and laundry, can eat away at your budget if you haven’t fully prepared for these expenses.

- Don’t get overwhelmed by immigration requirements: A lot of students can become overwhelmed by all the necessary requirements needed for applying and maintaining your immigration documents such as your study permit and visas. If you prepare early, meet your application deadlines and stay on top of the expiration dates for your passport, study permit and visas, your immigration owes won’t weigh you down.

- Don’t forget about language barriers: If you have chosen to study in a foreign speaking country, remember that there will be a learning curve to not only studying in a different language, but also communicating with residents. Learn the new language as well as the lingua franca (lingo) in your new space to keep informed of the slang and dialect that can help you to navigate your everyday world.

- Don’t Befriend Just Anyone: As you are not familiar with people and situations of the country, you need to be careful while making new friends. Remember, new students are more susceptible to scams and being taken advantage of in new environments.

- Don’t forget to become familiar with the laws of your new space: Every country has its own set of laws that you should abide by. Get to know the legal age for drinking, the regulations about driving as a foreign resident and your rights as a temporary resident in your new space. If you decide to live off campus in non-student housing, familiarize yourself with your rights as a tenant. Keep abreast with any changes in laws that may affect your ability to continue to live and study abroad.

It’s coming down to the last few weeks of summer, you are still struggling to purchase the 20 supplies on your child’s school book list, and you have yet to purchase school uniforms. How does every parent stay on top of these back to school costs without overextending their finances? Here are some smart ways to keep on track of your budget for your back to school expenses.Stay on top of back to school costs without overextending their finances.

Split-up spending

Instead of shopping for all your child's supplies at once, save money at the same time by spreading out purchases over a few weeks. Completing your spending in smaller chunks, helps you to start shopping early, and gives you time to get ready for the numerous shopping trips. Splitting your spending over several pay cheques is also a great way to stay on budget. In this way, you can spend smaller amounts of money during one shopping trip instead of waiting until the last minute and ending up with a huge shopping bill and items you don’t need.

Keep in line with your priorities

Create a back to school list to keep track of what’s needed versus what’s nice to have. A nice way of getting your children involved in the back to school shopping is to sit with them to create a personal shopping list of items that’s needed for school. This is your opportunity to help your child distinguish needs from wants. This is not only a good way to pass on your expert budgeting and money management skills to your children, but it also teaches them to prioritize.

Reuse and Reduce

Consider purchasing second-hand books and supplies. Many parents sell their old school books online or through social media and this is a great way to check off your school book list for half the cost. Reducing cost by passing down uniforms and reusing stationery from older siblings to younger ones is another smart budgeting technique.

Hunt for Savings and Deals

Be on the lookout for the big back-to-school sales and go to school and uniform supply stores early. Even the big stores can sell out of books, uniforms and other supplies at the last minute. Back to school happens every year so if you take the time to prepare for this year, you can use these same techniques next time around. Keep track of the budget you build this year and use that as a basis for next year; but anticipate different school needs. Also, use this time to plan for the next stages of your children’s education.